44++ How Do Taxes Work When You Own Your Own Business Information

How do taxes work when you own your own business. The form you use depends on how your business is organized. Each type of entity requires a different tax form on which you report your business income and expenses. For 2012 youll be able to deduct 555 cents per each mile driven as well as all business-related tolls and parking fees. This is called pass-through taxation. Any profit you made is added to your income and any losses are deducted from your income. Self-employment taxes cover Social Security and Medicare contributions. All businesses that make a profit must pay income taxes at the federal level. Some of the costs associated with gassing up and maintaining that car will be deductible. The full company tax rate is 30 and the lower company tax rate is 275. From the 20172018 income year your business is eligible for the lower rate if its a base rate entity. E-file Forms 940 941 943 944 or 945 for Small Businesses. Its a method HMRC use to collect income tax.

Getty Images Anyone who starts their own business eventually. Youll pay Social Security Medicare and income taxes through each type of business entity. Your next biggest concern is likely taxes and how they are connected to payroll and accounting. Reporting Information Returns Your business may be required to file information returns to report certain types of payments made during the year. How do taxes work when you own your own business The tax is based on assessed value the same as for personal assets like a house. Each method generates a tax bill. Refer to Business Structures to find out which returns you must file based on the business entity established. As a sole trader you pay tax on your business profits in your tax return rather than as a part of your wages so the tax code that your employer uses for. It may be helpful to use last years income deductions and tax credits as a starting point. If youre paying income tax on your salary your employer in this case your own company will deduct it from your salary under the PAYE Pay As You Earn scheme. The business structure you choose when starting a business will determine what. As a business owner its important to understand your federal state and local tax requirements. PAYE isnt a tax in its own right.

What S The Corporate Tax Rate Federal State Rates

What S The Corporate Tax Rate Federal State Rates

How do taxes work when you own your own business You must pay the tax as you earn or receive income during the year.

How do taxes work when you own your own business. In most cases if you are working for yourself and earned a living in 2020 you should expect to file a tax return in 2021. When its time to file a federal income tax return for your small business there are various ways you can do it depending on whether you run the business as a sole proprietorship or use a legal entity such as an LLC or corporation. Has an aggregated turnover less than 50 million from 20182019 25 million for 2017 2018.

As a sole proprietor or sole prop the details about your business are included on your own personal tax return. If your business made 35000 this year you made. It also files a report to the government when you hire a new.

This will help you file your taxes accurately and make payments on time. A base rate entity is a company that both. Do you use your car for business.

If owners want to set aside money in case of unemployment they need to do it themselves source. You can also use your previous years federal tax return as a guide. Many states also impose business income taxes of their own with similar but.

The company charges a base fee of 25 a month and automatically calculates all income state and federal payroll taxes you owe. You are probably a small business owner paying taxes as a sole proprietor LLC owner or partner. Property tax is a local tax.

Once youve figured out the number and e-file you can pay the IRS in a number of ways. Should you do your own taxes or is it time to outsource the work. You aim to hire the best of the best to work for your company but as you grow you want to make sure the people youve onboarded are still the right ones for the job.

The self-employment tax is a social security and Medicare tax for individuals who work for themselves. Self-employment tax is levied on business owners who do not pay themselves wages or do not withhold employment taxes from those wages as they go. The federal income tax is a pay-as-you-go tax.

Your decision about a salary or owners draw should be based. Do you own a company car. In these cases you must pay your business income taxes through your personal tax return.

If youre running your own business as a sole trader then youll only have one tax code assuming you only have one day job. If your business owns real property real estate like a building it must pay property tax to the local taxing authority which is usually the city or county where the property is located. You can figure out your estimated tax payments as a business owner using Form 1040-ES.

How do taxes work when you own your own business You can figure out your estimated tax payments as a business owner using Form 1040-ES.

How do taxes work when you own your own business. If your business owns real property real estate like a building it must pay property tax to the local taxing authority which is usually the city or county where the property is located. If youre running your own business as a sole trader then youll only have one tax code assuming you only have one day job. In these cases you must pay your business income taxes through your personal tax return. Do you own a company car. Your decision about a salary or owners draw should be based. The federal income tax is a pay-as-you-go tax. Self-employment tax is levied on business owners who do not pay themselves wages or do not withhold employment taxes from those wages as they go. The self-employment tax is a social security and Medicare tax for individuals who work for themselves. You aim to hire the best of the best to work for your company but as you grow you want to make sure the people youve onboarded are still the right ones for the job. Should you do your own taxes or is it time to outsource the work. Once youve figured out the number and e-file you can pay the IRS in a number of ways.

Property tax is a local tax. You are probably a small business owner paying taxes as a sole proprietor LLC owner or partner. How do taxes work when you own your own business The company charges a base fee of 25 a month and automatically calculates all income state and federal payroll taxes you owe. Many states also impose business income taxes of their own with similar but. You can also use your previous years federal tax return as a guide. If owners want to set aside money in case of unemployment they need to do it themselves source. Do you use your car for business. A base rate entity is a company that both. This will help you file your taxes accurately and make payments on time. It also files a report to the government when you hire a new. If your business made 35000 this year you made.

Indeed lately has been sought by users around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view video and image information for inspiration, and according to the title of this post I will talk about about How Do Taxes Work When You Own Your Own Business.

As a sole proprietor or sole prop the details about your business are included on your own personal tax return. Has an aggregated turnover less than 50 million from 20182019 25 million for 2017 2018. When its time to file a federal income tax return for your small business there are various ways you can do it depending on whether you run the business as a sole proprietorship or use a legal entity such as an LLC or corporation. In most cases if you are working for yourself and earned a living in 2020 you should expect to file a tax return in 2021. How do taxes work when you own your own business .

How do taxes work when you own your own business

How do taxes work when you own your own business. If youre running your own business as a sole trader then youll only have one tax code assuming you only have one day job. If your business owns real property real estate like a building it must pay property tax to the local taxing authority which is usually the city or county where the property is located. You can figure out your estimated tax payments as a business owner using Form 1040-ES. If youre running your own business as a sole trader then youll only have one tax code assuming you only have one day job. If your business owns real property real estate like a building it must pay property tax to the local taxing authority which is usually the city or county where the property is located. You can figure out your estimated tax payments as a business owner using Form 1040-ES.

If you re searching for How Do Taxes Work When You Own Your Own Business you've reached the ideal location. We have 51 images about how do taxes work when you own your own business adding pictures, photos, photographs, backgrounds, and more. In these webpage, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

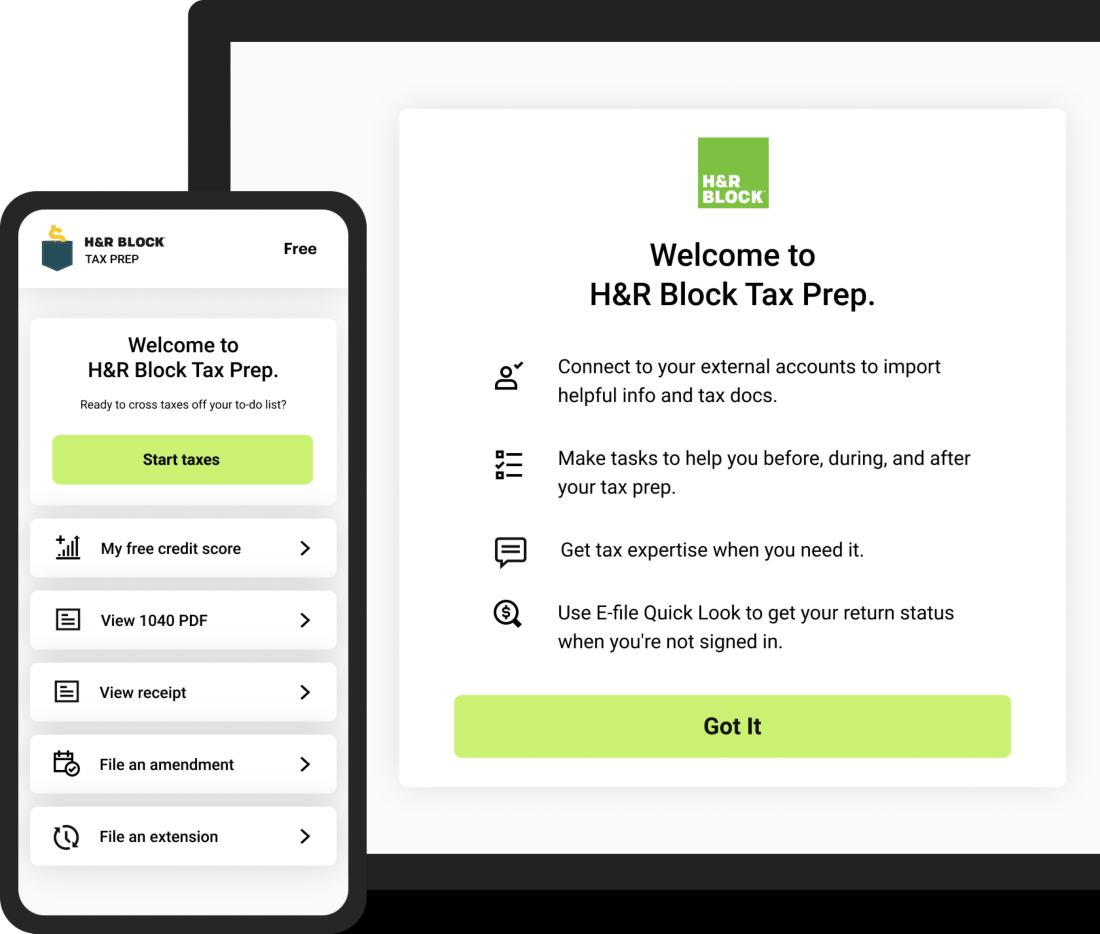

How To File Your Small Business Taxes Free Checklist Gusto

How To File Your Small Business Taxes Free Checklist Gusto